(Graphic: Business Wire)

(Graphic: Business Wire)

전자상거래 사기 방지 및 리스크 인텔리전스 분야의 리더인 리스키파이드(Riskified) (https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fwww.riskified.com%2F%3Futm_source%3Dcomms%26utm_medium%3Dpress_release%26utm_campaign%3Dadaptive_checkout_2025&esheet=54219270&newsitemid=20250305247308&lan=en-US&anchor=Riskified&index=1&md5=b6b876125ef4b263432b1a93500a2414)가 ‘어댑티브 체크아웃(Adaptive Checkout) (https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fwww.riskified.com%2Fadaptive-checkout%2F%3Futm_source%3Dcomms%26utm_medium%3Dpress_release%26utm_campaign%3Dadaptive_checkout_2025&esheet=54219270&newsitemid=20250305247308&lan=en-US&anchor=Adaptive+Checkout&index=2&md5=412cd732494adc4b8fdedb9fd466c050)’의 출시를 발표했다.

어댑티브 체크아웃은 정상 주문을 부당하게 거절하지 않는 동시에 전자상거래 판매자에 대한 사기 행위를 완화함으로써 전환율을 높일 수 있도록 설계된 획기적인 솔루션이다. 이 고급 구성의 리스키파이드 차지백 보증(Chargeback Guarantee) 제품은 강력하고 새로운 전환 최적화 엔진을 통합하여 기존 사기 방지 모델을 개선한다. 이 엔진은 각 거래의 위험 수준에 맞게 결제 프로세스를 지능적으로 조정하여 합법적 거래의 승인을 늘리면서 사기는 줄여준다.

기존의 사기 방지 시스템은 중첩된 규칙에 의존하여 승인/거절을 이분법적으로 결정하기 때문에 거절 오류, 고객 불쾌감, 매출 손실로 이어질 수 있었다. 리스키파이드의 어댑티브 체크아웃은 주문의 고유한 위험 프로필, 신원의 쇼핑 내역, 리스키파이드의 글로벌 판매자 네트워크에서 수집한 수억 개의 데이터 접점을 기반으로 각 결제 과정을 지능적으로 조정함으로써 이러한 기존 모델에서 탈피한다. AI를 활용하는 어댑티브 체크아웃은 각 거래의 결제 흐름을 맞춤 설정하고 일부 고위험 주문에 대해 추가 보안 조치를 정밀하게 적용하여 판매자가 프로세스의 여러 단계에서 진짜 주문에 대한 승인은 늘리고, 사기는 차단할 수 있도록 지원한다.

리스키파이드의 최고경영자 겸 공동 창립자인 에이도 갈(Eido Gal)은 “사기범들의 수법이 점점 더 교묘해짐에 따라 전자상거래 판매자는 거절 오류를 통해 정상적인 고객을 잃을 위험에 직면해 있고, 이는 매출에 직접적인 영향을 미칠 수 있다. 판매자들이 이 중요한 문제를 제기해준 결과, 전자상거래 전환을 더욱 최적화할 수 있는 어댑티브 체크아웃을 개발할 수 있었다. AI를 활용하여 위험을 평가하고 결제 환경을 실시간으로 조정함으로써 판매자는 가능한 한 많은 합법적인 거래를 승인해야 할 필요와 사기 방지 간에 균형을 맞출 수 있다”고 말했다.

어댑티브 체크아웃은 위험 프로필에 따라 특정 흐름의 순서를 지정하여 필요한 경우에만 신용카드 CVV 입력, 일회용 비밀번호(OTP) 발급 또는 3DS로 라우팅하는 등의 추가 신원 확인을 선택적으로 적용한다. 이렇게 하면 선량한 고객의 중단을 최소화하면서 사기 거래를 효과적으로 필터링할 수 있다. 어댑티브 체크아웃의 일부인 리스키파이드는 발급사의 승인 확인 단계에 도달하기 전에 노골적인 사기를 걸러내고 강화된 주문 데이터를 파트너 발급사에 전송하여 이들이 합법적인 거래를 더 쉽게 식별하고 승인할 수 있도록 지원한다.

틱픽(TickPick)은 100% 보증 라이브 이벤트 티켓을 판매하는 선도적인 온라인 마켓플레이스이며, 수수료가 없는 유일한 주요 사이트이다. 틱픽은 리스키파이드와 협력하여 증가하는 고객층이 쉽게 거래하면서 사기 행위를 정확하게 차단할 수 있도록 지원했다. 결제 흐름 속에 전략적 분석 터치포인트를 구현한 이후 틱픽은 사기 위험으로 인해 거절 당할 수 있었던 300만달러의 추가 매출을 승인할 수 있었다. 리스키파이드의 운영 담당 수석부사장인 잭 슬링랜드(Jack Slingland)는 “고객 경험을 더욱 향상하고 사기 비용을 낮추며 장기적인 성공을 가능하게 하는 혁신적인 솔루션을 개발하는 데 있어 리스키파이드와 협력하게 되어 매우 기쁘다”고 밝혔다.

어댑티브 체크아웃을 사용하면 판매자는 더 많은 정상 주문을 안심하고 승인하면서 거절 오류를 줄이고, 승인율을 개선하고, 전반적인 고객 경험을 향상하여 궁극적으로 매출 증가와 고객 유지율 향상이라는 결과를 얻을 수 있다. 이 첨단 솔루션은 사기 방지 및 결제팀이 회사의 매출 성장에 측정 가능한 영향을 미칠 수 있는 기능을 제공한다. 어댑티브 체크아웃 데모 비디오 (https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fwww.riskified.com%2Flp%2Fadaptive-checkout%2Fwatch%2F%3Futm_source%3Dcomms%26utm_medium%3Dpress_release%26utm_campaign%3Dadaptive_checkout_2025&esheet=54219270&newsitemid=20250305247308&lan=en-US&anchor=Adaptive+Checkout+demo+video&index=3&md5=634ba1fe559a5ba6a6963b1c33bdcb6c)를 Riskified.com에서 시청할 수 있다.

리스키파이드 소개

리스키파이드(Riskified)(뉴욕증권거래소:RSKD)는 기업이 리스크에 대처해 전자상거래 성장을 촉진할 수 있도록 지원한다. 온라인에서 판매하는 세계 최대 규모의 브랜드와 상장 기업 중 다수가 리스키파이드를 통해 환불에 대한 보장된 보호를 확보해 대규모 사기와 정책 남용에 대응하고 고객 유지율을 개선하고 있다. 최대 규모의 전자상거래 리스크 애널리스트, 데이터 과학자, 연구자 팀이 개발하고 관리하는 리스키파이드의 AI 기반 사기 및 리스크 인텔리전스 플랫폼은 각 상호작용의 배후에 있는 개인을 분석해 실시간 결정과 강력한 신원 기반 통찰력을 제공한다. 리스키파이드는 2024년 CNBC의 세계 최고 핀테크 기업에 선정됐다. 웹사이트: riskified.com

BeiGene (https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fwww.beigene.com%2F&esheet=54216036&newsitemid=20250227911272&lan=en-US&anchor=BeiGene&index=1&md5=e2cdff0a0d83750ab7730987260a7cc7), Ltd. (NASDAQ: ONC; HKEX: 06160; SSE: 688235), a global oncology company that intends to change its name to BeOne Medicines Ltd., today announced financial results and corporate updates from the fourth quarter and full year 2024.

“Our fourth quarter and full year results demonstrate our tremendous growth as a global oncology powerhouse, reinforced by the continued success of BRUKINSA and the development of one of the most prolific solid tumor pipelines in oncology with multiple data readouts expected this year,” said John V. Oyler, Co-Founder, Chairman, and CEO at BeiGene. “BRUKINSA is now the unequivocal leader in new CLL patient starts in the U.S., holds the broadest label of any BTK inhibitor and serves as the cornerstone of our hematology franchise, showing immense promise as a backbone alongside our late stage BCL2 inhibitor, sonrotoclax, and our potential first-in-class BTK CDAC. We are also building future solid tumor franchises in breast, lung, and gastrointestinal cancers by leveraging our platforms in multi-specific antibodies, protein degraders and antibody-drug conjugates. 2025 marks an inflection point as we anticipate achieving positive GAAP operating income and operating cash flow alongside our intention to change our name to BeOne with our new NASDAQ ticker, ONC.”

Fourth Quarter and Full Year 2024 Financial Snapshot

(Amounts in thousands of U.S. dollars and unaudited)

(To view the table, please visit https://bwnews.pr/3XwwdT3)

* For an explanation of our use of non-GAAP financial measures refer to the “Note Regarding Use of Non-GAAP Financial Measures” section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measures, see the table at the end of this press release.

Key Business Updates

BRUKINSA® (zanubrutinib) is an orally available, small molecule inhibitor of BTK designed to deliver complete and sustained inhibition of the BTK protein by optimizing bioavailability, half-life, and selectivity. With differentiated pharmacokinetics compared with other approved BTK inhibitors, BRUKINSA has been demonstrated to inhibit the proliferation of malignant B cells within a number of disease-relevant tissues. BRUKINSA has the broadest label globally of any BTK inhibitor and is the only BTK inhibitor to provide the flexibility of once or twice daily dosing. The BRUKINSA clinical development program includes approximately 7,100 patients enrolled to date in more than 30 countries and regions across more than 35 trials. BRUKINSA is approved in more than 70 markets, and more than 180,000 patients have been treated globally.

·U.S. sales of BRUKINSA totaled $616 million and $2.0 billion in the fourth quarter and full year of 2024, representing growth of 97% and 106%, respectively, over the prior-year periods, with more than 60% of the quarter-over-quarter demand growth coming from expanded use in chronic lymphocytic leukemia (CLL) as BRUKINSA continued to gain share as the leader in new patient starts in the U.S. in CLL and all other approved indications; BRUKINSA sales in Europe totaled $113 million and $359 million in the fourth quarter and full year 2024, representing growth of 148% and 194%, respectively, compared to the prior-year periods, driven by increased market share across all major markets, including Germany, Italy, Spain, France and the UK; and

·Entered into a patent litigation settlement agreement with MSN Pharmaceuticals, Inc. and MSN Laboratories Private Ltd. granting MSN the right to sell a generic version of BRUKINSA in the U.S. no earlier than June 15, 2037, subject to potential acceleration or extension under circumstances customary for settlement of this type.

TEVIMBRA® (tislelizumab) is a uniquely designed humanized immunoglobulin G4 (IgG4) anti-programmed cell death protein 1 (PD-1) monoclonal antibody with high affinity and binding specificity against PD-1; it is designed to minimize binding to Fc-gamma (Fcγ) receptors on macrophages, helping to aid the body’s immune cells to detect and fight tumors. TEVIMBRA is the foundational asset of BeiGene’s solid tumor portfolio and has shown potential across multiple tumor types and disease settings. The TEVIMBRA clinical development program includes almost 14,000 patients enrolled to date in 35 counties and regions across 70 trials, including 21 registration-enabling studies. TEVIMBRA is approved in 45 markets, and more than 1.3 million patients have been treated globally.

·Sales of tislelizumab totaled $154 million and $621 million in the fourth quarter and full year 2024, representing growth of 20% and 16%, respectively, compared to the prior-year periods;

·Received U.S. Food and Drug Administration (FDA) approval in combination with platinum and fluoropyrimidine-based chemotherapy for the first-line treatment of unresectable or metastatic HER2-negative gastric or gastroesophageal junction adenocarcinoma in adults whose tumors express PD-L1 (≥1); and

·Received European Commission (EC) approval in combination with chemotherapy for the first-line treatment of esophageal squamous cell carcinoma and gastric or gastroesophageal junction adenocarcinoma.

Key Pipeline Highlights

BeiGene’s portfolio strategy emphasizes rapid generation of early-stage clinical proof-of-concept data enabled by its speed- and cost-advantaged (“Fast to Proof of Concept”) approach to global development operations. The Company’s in-house global research and development team, including clinical operations and development, is comprised of nearly 3,700 colleagues conducting trials across six continents and striving to ensure rigorous data quality through collaborations with regulators and investigators in over 45 countries. This strategic approach maximizes resources by channeling data-gated investments into the most promising clinically differentiated candidates quickly and de-prioritizing others. With one of the largest oncology research teams in the industry, BeiGene has demonstrated strengths in translational small molecule and biologics discovery, including three platform technologies: multi-specific antibodies, chimeric degradation activation compounds (CDACs), and antibody-drug conjugates (ADCs).

Hematology

BRUKINSA

·At the American Society of Hematology (ASH) Annual meeting, presented 5-year follow-up from SEQUOIA study; with adjustment for COVID-19 impact, the study demonstrated treatment with BRUKINSA reduced the risk of progression or death by 75% compared to bendamustine-rituximab in patients with treatment-naïve (TN) CLL;

·Anticipate FDA and EC approvals of BRUKINSA tablet formulation in the second half of 2025;

·Anticipate an interim analysis of progression-free survival for the Phase 3 MANGROVE study in TN mantle cell lymphoma (MCL) in the second half of 2025; and

·Anticipate completing enrollment for the relapsed/refractory (R/R) follicular lymphoma portion of the Phase 3 MAHOGANY study in the second half of 2025.

Sonrotoclax (BCL2 inhibitor)

·Planned data readouts in R/R CLL and R/R MCL Phase 2 trials and potential accelerated approval submissions in the second half of 2025;

·At ASH, presented data from the 320 mg expansion cohort of a Phase 1/1b study at a median follow-up of 1.5 years demonstrating no progression in patients with TN CLL in combination with BRUKINSA;

·More than 1,800 patients enrolled to date across the program;

·Completed enrollment in Phase 3 CELESTIAL study in TN CLL;

·Anticipate enrolling first subjects in global Phase 3 trials in R/R CLL and R/R MCL in the first half of 2025; and

·Continued enrollment in global Phase 2 trial in Waldenström’s macroglobulinemia.

BGB-16673 (BTK CDAC)

·Continued to enroll potentially registration enabling R/R CLL Phase 2 study with data readout expected in 2026;

·More than 500 patients enrolled to date across the program;

·Anticipate initiation of Phase 3 trial in R/R CLL compared to physician’s choice in the first half of 2025; and

·Anticipate initiation of Phase 3 head-to-head trial against noncovalent BTK inhibitor pirtobrutinib in R/R CLL in the second half of 2025.

Solid Tumors

Anticipate data readouts for BGB-43395 (CDK4 inhibitor), BG-68501 (CDK2 inhibitor) and BG-C9074 (B7H4 ADC) in the first half of 2025, and internal proof-of-concept data for BG-60366 (EGFR CDAC), BGB-53038 (panKRAS inhibitor), BG-C137 (FGFR2b ADC), BGB-C354 (B7H3 ADC), and BG-C477 (CEA ADC) in the second half of 2025.

Lung Cancer

·Tarlatamab (AMG757, DLL3xCD3 BiTE): anticipate data readout from Phase 3 study in second-line small cell lung cancer in the first half of 2025;

·Advan-TIG-302 (TIGIT antibody): anticipate interim data readout from Phase 3 study in first-line PD(L)1-high non small cell lung cancer in the second half of 2025;

·BG-60366 (EGFR CDAC): entered into the clinic in the fourth quarter of 2024; differentiated degrader mechanism to completely abolish EGFR signaling; highly potent across osimertinib-sensitive and resistant EGFR mutations; strong preclinical efficacy data with oral and daily dosing;

·BG-89894 (MAT2A inhibitor): entered dose escalation in fourth quarter of 2024; potential best-in-class characteristics with superior potency and brain penetration; strong synergy between PRMT5i and MAT2Ai in preclinical models;

·BGB-58067 (MTA-cooperative PRMT5 inhibitor): entered into the clinic in the beginning of January 2025; best-in-class potential with high potency, selectivity, and brain penetrability; and

·BG-T187 (EGFR x MET trispecific antibody): initiated dose escalation in fourth quarter of 2024; differentiated MET biparatopic design with optimal MET inhibitory activity to pursue best-in-class opportunity.

Breast and Gynecologic Cancers

·BGB-43395 (CDK4 inhibitor): continued dose escalation in monotherapy and in combination with fulvestrant and letrozole in the anticipated efficacious dose range; more than 180 patients enrolled to date and proof-of-concept expected in the first half of 2025; planning underway for Phase 3 trial in second-line HR+/HER2- metastatic breast cancer in combination with endocrine therapy; and

·BG-68501(CDK2 inhibitor) and BG-C9074 (B7H4 ADC): continued monotherapy dose escalation; more than 50 patients and more than 70 patients enrolled to date, respectively.

Gastrointestinal Cancers

·Zanidatamab (HER2 bispecific antibody) in combination with tislelizumab and chemotherapy: anticipate primary PFS data readout from Phase 3 study in first-line HER2-positive gastroesophageal adenocarcinoma in the second half of 2025; and

·NMEs advanced into the clinic in the fourth quarter of 2024:

·BGB-53038 (panKRAS inhibitor): highly potent and selective with broad activity against KRAS mutations in multiple tumor types; limits toxicity by sparing other RAS proteins; KRAS mutations are present in 19 percent of cancers; and

·BG-C137 (FGFR2b ADC): potential first-in-class ADC for a validated target in upper gastrointestinal and breast cancers; potential superior efficacy compared to leading monoclonal antibody in both high- and medium-expression models.

Inflammation and Immunology

BGB-45035 (IRAK4 CDAC): currently in dose escalation in both SAD and MAD cohorts with more than 130 subjects enrolled; potent and selective degrader that targets both kinase and scaffold functions of IRAK4 for complete target degradation; Phase 2 study planned in 2025; proof-of-concept for tissue IRAK4 degradation in the second half of 2025.

Corporate Updates

·Announced intent to change the Company’s name to BeOne Medicines, pending shareholder approval; the new name reflects the Company’s commitment to develop innovative medicines to eliminate cancer by partnering with the global community to serve as many patients as possible;

·Announced a global licensing agreement with CSPC Zhongqi Pharmaceutical Technology (Shijiazhuang) Co., Ltd. for SYH2039 (BG-89894), a novel MAT2A inhibitor being explored for solid tumors as monotherapy and in combination with BGB-58067 (MTA-cooperative PRMT5 inhibitor);

·Changed the Company’s Nasdaq stock ticker from “BGNE” to “ONC”; and

·Hosted an investor webinar on December 16, 2024, highlighting key data from the hematology franchise from the ASH 2024 and the 2024 San Antonio Breast Cancer Symposium and presented at the 2025 J.P. Morgan Healthcare Conference on January 13, 2025. Replays and materials can be found at the Investor Events and Presentations (https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fir.beigene.com%2Fnews-events%2Fevents-presentations%2F&esheet=54216036&newsitemid=20250227911272&lan=en-US&anchor=Investor+Events+and+Presentations&index=2&md5=c26e009344f3db5bc7dcde057708d3be) section of the Company’s website.

Fourth Quarter and Full Year 2024 Financial Highlights

Revenue for the fourth quarter and full year 2024 was $1.1 billion and $3.8 billion, respectively, compared to $634 million and $2.5 billion in the prior-year periods driven primarily by growth in BRUKINSA product sales in the U.S. and Europe.

Product Revenue totaled $1.1 billion and $3.8 billion for the fourth quarter and full year 2024, respectively, compared to $631 million and $2.2 billion in the prior-year periods. The increase in product revenue was primarily attributable to increased sales of BRUKINSA. For the quarter and full year 2024, the U.S. was the Company’s largest market, with product revenue of $616 million and $2.0 billion, respectively, compared to $313 million and $946 million, respectively, in the prior-year periods. U.S. sales were also positively impacted in the fourth quarter of 2024 by seasonality and the timing of customer order patterns of approximately $30 million. In addition to BRUKINSA revenue growth, product revenues were positively impacted by growth from in-licensed products from Amgen and tislelizumab.

Gross Margin as a percentage of global product sales for the fourth quarter and full year 2024 was 85.6% and 84.3%, respectively, compared to 83.2% and 82.7% in the prior-year periods on a GAAP basis. The gross margin percentage increased in both the quarter-over-quarter and year-over-year periods due to a proportionally higher sales mix of global BRUKINSA compared to other products in our portfolio, partially offset by the impact of accelerated depreciation expense of $16 million and $33 million, respectively, for the fourth quarter and full year 2024 resulting from the move to more efficient, larger scale production lines for tislelizumab. On an adjusted basis, which does not include the accelerated depreciation, gross margin as a percentage of product sales increased to 87.4% and 85.5% for the fourth quarter and full year 2024, respectively, compared to 83.7% and 83.2%, respectively, in the prior-year periods.

Operating Expenses

The following table summarizes operating expenses for the fourth quarter 2024 and 2023, respectively:

(To view the table, please visit https://bwnews.pr/3XwwdT3)

The following table summarizes operating expenses for the full year 2024 and 2023, respectively:

(To view the table, please visit https://bwnews.pr/3XwwdT3)

Research and Development (R&D) Expenses increased for the fourth quarter and full year 2024 compared to the prior-year periods on both a GAAP and adjusted basis primarily due to advancing preclinical programs into the clinic and early clinical programs into late stage. Upfront fees and milestone payments related to in-process R&D for in-licensed assets totaled $63 million and $114 million in the fourth quarter and full year 2024, respectively, compared to $31.8 million and $46.8 million in the prior-year periods.

Selling, General and Administrative (SG&A) Expenses increased for the fourth quarter and full year 2024 compared to the prior-year periods on both a GAAP and adjusted basis due to continued investment in the global commercial launch of BRUKINSA primarily in the U.S. and Europe. SG&A expenses as a percentage of product sales were 45% and 48% for the fourth quarter and full year 2024, respectively, compared to 66% and 69% in the prior-year periods.

Net Loss

GAAP net loss improved for the fourth quarter and full year 2024, as compared to the prior-year periods, primarily attributable to reduced operating losses.

For the fourth quarter of 2024, net loss per share was $0.11 per share and $1.43 per American Depositary Share (ADS), compared to $0.27 per share and $3.53 per ADS in the prior-year period. Net loss for full year 2024 was $0.47 per share and $6.12 per ADS, compared to $0.65 per share and $8.45 per ADS in the prior-year period.

Cash Provided by Operations for the fourth quarter 2024 was $75 million, an increase of $297 million over the prior-year period. For full year 2024, cash used in operations was $141 million, a decrease of $1.0 billion from the prior-year period. The improvement in operating cash flows in the period was primarily driven by improved GAAP operating loss and non-GAAP operating income.

For further details on BeiGene’s 2024 Financial Statements, please see BeiGene’s Annual Report on Form 10-K for fiscal year 2024 filed with the U.S. Securities and Exchange Commission.

Full Year 2025 Guidance

BeiGene’s financial guidance is summarized below:

(To view the table, please visit https://bwnews.pr/3XwwdT3)

[1] Does not assume any potential new, material business development activity or unusual/non-recurring items. Assumes January 31, 2025 foreign exchange rates.

BeiGene’s total revenue guidance for full year 2025 of $4.9 billion to $5.3 billion includes expectations for strong revenue growth driven by BRUKINSA’s U.S. leadership position and continued global expansion in both Europe and other important rest of world markets. Gross margin percentage is expected to be in the mid-80% range due to mix and production efficiencies as compared to 2024. BeiGene’s guidance for combined operating expenses on a GAAP basis includes expectations of investment to support growth in both commercial and research at a pace that continues to deliver meaningful operating leverage. Non-GAAP operating expenses, which exclude costs related to share-based compensation, depreciation and amortization expense, are expected to track with GAAP operating expenses, with reconciling items unchanged from existing practice. Operating expense guidance does not assume any potential new, material business development activity or unusual/non-recurring items.

Conference Call and Webcast

The Company’s earnings conference call for the fourth quarter and full year 2024 will be broadcast via webcast at 8:00 a.m. ET on Thursday, February 27, 2025, and will be accessible through the Investors section of BeiGene’s website, www.beigene.com. Supplemental information in the form of a slide presentation and a replay of the webcast will also be available.

About BeiGene

BeiGene, which plans to change its name to BeOne Medicines Ltd., is a global oncology company that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. With a broad portfolio, we are expediting development of our diverse pipeline of novel therapeutics through our internal capabilities and collaborations. We are committed to radically improving access to medicines for far more patients who need them. Our growing global team of more than 11,000 colleagues spans six continents. To learn more about BeiGene, please visit www.beigene.com and follow us on LinkedIn, X (formerly known as Twitter), Facebook and Instagram.

BeiGene intends to use the Investors section of its website, its X (formerly known as Twitter) account at x.com/BeiGeneGlobal, its LinkedIn account at linkedin.com/company/BeiGene, its Facebook account at facebook.com/BeiGeneGlobal, and its Instagram account at instagram.com/BeiGeneGlobal to disclose material information and to comply with its disclosure obligations under Regulation FD. Accordingly, investors should monitor BeiGene’s website, its X account, its LinkedIn account, its Facebook account, and its Instagram account in addition to BeiGene’s press releases, SEC filings, public conference calls, presentations, and webcasts.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding timing of proof-of-concept data readouts, clinical trial activities and readouts, study enrollment, and regulatory approvals; BeiGene’s future revenue, operating income, cash flow, operating expenses and gross margin percentage; the future of BeiGene’s solid tumor pipeline and its ability to address unmet patient need across multiple disease areas and therapeutic modalities; the future success of BeiGene’s clinical trials and new molecular entities; and BeiGene’s plans, commitments, aspirations and goals under the caption “About BeiGene”. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including BeiGene’s ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene’s ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene’s ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene’s reliance on third parties to conduct drug development, manufacturing, commercialization, and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products; BeiGene’s ability to obtain additional funding for operations and to complete the development of its drug candidates and achieve and maintain profitability; and those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent annual report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in BeiGene’s subsequent filings with the U.S. Securities and Exchange Commission. All information in this press release is as of the date of this press release, and BeiGene undertakes no duty to update such information unless required by law. BeiGene’s financial guidance is based on estimates and assumptions that are subject to significant uncertainties.

(To view the table, please visit https://bwnews.pr/3XwwdT3)

Note Regarding Use of Non-GAAP Financial Measures

BeiGene provides certain non-GAAP financial measures, including Adjusted Operating Expenses and Adjusted Operating Loss and certain other non-GAAP income statement line items, each of which include adjustments to GAAP figures. These non-GAAP financial measures are intended to provide additional information on BeiGene’s operating performance. Adjustments to BeiGene’s GAAP figures exclude, as applicable, non-cash items such as share-based compensation, depreciation and amortization. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. BeiGene maintains an established non-GAAP policy that guides the determination of what costs will be excluded in non-GAAP financial measures and the related protocols, controls and approval with respect to the use of such measures. BeiGene believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of BeiGene’s operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company’s historical and expected financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators BeiGene’s management uses for planning and forecasting purposes and measuring the Company’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

(To view the table, please visit https://bwnews.pr/3XwwdT3)

View source version on businesswire.com: https://www.businesswire.com/news/home/20250227911272/en/

파퓰러스, 펜트리스 아키텍츠 인수로 글로벌 항공 포트폴리오 확대

스포츠 및 엔터테인먼트 행사장을 전문으로 다루는 세계적으로 유명한 디자인 회사 파퓰러스(Populous)는 오늘 덴버에 본사를 둔 펜트리스 아키텍츠(Fentress Architects)의 인수를 발표했다. 펜트리스 아키텍츠는 상징적인 항공 프로젝트와 컨벤션 센터, 박물관, 정부 시설을 포함한 유명 공공 건물 분야의 글로벌 리더이다. 이 전략적 인수를 통해 건축계에서 가장 존경받는 두 이름이 하나로 합쳐져, 기억에 남는 경험을 디자인하는 파퓰러스의 탁월한 전문성과 항공, 도시 및 문화 랜드마크 분야에서 수상 경력에 빛나는 펜트리스의

파퓰러스, 펜트리스 아키텍츠 인수로 글로벌 항공 포트폴리오 확대

스포츠 및 엔터테인먼트 행사장을 전문으로 다루는 세계적으로 유명한 디자인 회사 파퓰러스(Populous)는 오늘 덴버에 본사를 둔 펜트리스 아키텍츠(Fentress Architects)의 인수를 발표했다. 펜트리스 아키텍츠는 상징적인 항공 프로젝트와 컨벤션 센터, 박물관, 정부 시설을 포함한 유명 공공 건물 분야의 글로벌 리더이다. 이 전략적 인수를 통해 건축계에서 가장 존경받는 두 이름이 하나로 합쳐져, 기억에 남는 경험을 디자인하는 파퓰러스의 탁월한 전문성과 항공, 도시 및 문화 랜드마크 분야에서 수상 경력에 빛나는 펜트리스의

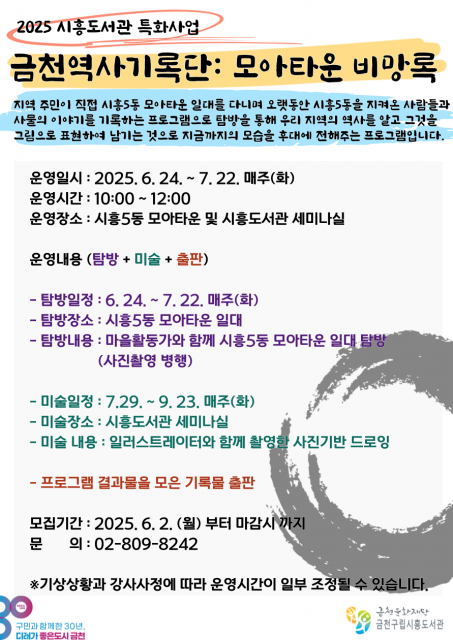

금천구립시흥도서관, 주민이 직접 역사를 기억하는 ‘금천역사기록단 : 모아타운 비망록’ 운영

금천문화재단(대표이사 서영철) 금천구립시흥도서관은 오는 6월 24일부터 금천구 지역의 모습을 기록하고 주민의 목소리를 담는 ‘금천역사기록단 : 모아타운 비망록’을 운영한다고 밝혔다. 이번 사업은 금천구립시흥도서관의 특화사업으로 지역을 탐방하며 관찰하고 기록해 미술작품으로 표현하고 이를 엮어 책으로 발간하는 과정이다. 올해의 주제는 ‘시흥 5동 모아타운’이다. ‘모아타운’은 서울시에서 진행하는 소규모 저층 주택 정비 사업으로, 시흥 5동 일대도 해당 사업 대상지이다. 해당 지역 정비를 앞두고 오랜 기간 구민들의 삶의 터전이었던 시흥5

금천구립시흥도서관, 주민이 직접 역사를 기억하는 ‘금천역사기록단 : 모아타운 비망록’ 운영

금천문화재단(대표이사 서영철) 금천구립시흥도서관은 오는 6월 24일부터 금천구 지역의 모습을 기록하고 주민의 목소리를 담는 ‘금천역사기록단 : 모아타운 비망록’을 운영한다고 밝혔다. 이번 사업은 금천구립시흥도서관의 특화사업으로 지역을 탐방하며 관찰하고 기록해 미술작품으로 표현하고 이를 엮어 책으로 발간하는 과정이다. 올해의 주제는 ‘시흥 5동 모아타운’이다. ‘모아타운’은 서울시에서 진행하는 소규모 저층 주택 정비 사업으로, 시흥 5동 일대도 해당 사업 대상지이다. 해당 지역 정비를 앞두고 오랜 기간 구민들의 삶의 터전이었던 시흥5

에스제이엠 ‘2025년 글로벌 강소기업 1000+ 프로젝트’에서 ‘강소+’ 단계 최종 선정

자동차 부품 전문기업 에스제이엠이 중소벤처기업부가 주관하는 ‘2025년 글로벌 강소기업 1000+ 프로젝트’에서 ‘강소+’ 단계에 최종 선정됐다. 이에 6월 5일 경기지방중소벤처기업청에서 지정서와 현판을 수여받았다. ‘글로벌 강소기업 1000+ 프로젝트’는 세계 시장에서 경쟁력 있는 기술과 제품을 보유한 성장 가능성이 높은 수출 중소기업을 발굴해 글로벌 수출 선도 기업으로 육성하고자 마련된 정부의 대표 중소기업 지원 사업이다. 선정은 기업의 성장성, 혁신성, 글로벌 진출 역량 등 엄격한 기준을 바탕으로 이뤄지며, 국내외 시장에서 기

에스제이엠 ‘2025년 글로벌 강소기업 1000+ 프로젝트’에서 ‘강소+’ 단계 최종 선정

자동차 부품 전문기업 에스제이엠이 중소벤처기업부가 주관하는 ‘2025년 글로벌 강소기업 1000+ 프로젝트’에서 ‘강소+’ 단계에 최종 선정됐다. 이에 6월 5일 경기지방중소벤처기업청에서 지정서와 현판을 수여받았다. ‘글로벌 강소기업 1000+ 프로젝트’는 세계 시장에서 경쟁력 있는 기술과 제품을 보유한 성장 가능성이 높은 수출 중소기업을 발굴해 글로벌 수출 선도 기업으로 육성하고자 마련된 정부의 대표 중소기업 지원 사업이다. 선정은 기업의 성장성, 혁신성, 글로벌 진출 역량 등 엄격한 기준을 바탕으로 이뤄지며, 국내외 시장에서 기

에스티 로더 컴퍼니즈, 리사 세퀴노를 메이크업 브랜드 클러스터 사장으로 임명

에스티 로더 컴퍼니즈(Estée Lauder Companies Inc.)(뉴욕증권거래소: EL)가 리사 세퀴노(Lisa Sequino)를 메이크업 브랜드 클러스터 신임 사장으로 임명한다고 발표했다. 이 직책은 메이크업의 전략적 방향과 글로벌 성장을 주도하고 M·A·C, 바비 브라운(Bobbi Brown), 투페이스드(Too Faced), 스매쉬박스(Smashbox) 및 글램글로우(GLAMGLOW)를 포함한 회사 메이크업 브랜드 포트폴리오를 총괄하는 역할이다. 세퀴노는 수석부사장 겸 최고브랜드책임자인 제인 헤르츠마크 후디스(Jane

에스티 로더 컴퍼니즈, 리사 세퀴노를 메이크업 브랜드 클러스터 사장으로 임명

에스티 로더 컴퍼니즈(Estée Lauder Companies Inc.)(뉴욕증권거래소: EL)가 리사 세퀴노(Lisa Sequino)를 메이크업 브랜드 클러스터 신임 사장으로 임명한다고 발표했다. 이 직책은 메이크업의 전략적 방향과 글로벌 성장을 주도하고 M·A·C, 바비 브라운(Bobbi Brown), 투페이스드(Too Faced), 스매쉬박스(Smashbox) 및 글램글로우(GLAMGLOW)를 포함한 회사 메이크업 브랜드 포트폴리오를 총괄하는 역할이다. 세퀴노는 수석부사장 겸 최고브랜드책임자인 제인 헤르츠마크 후디스(Jane

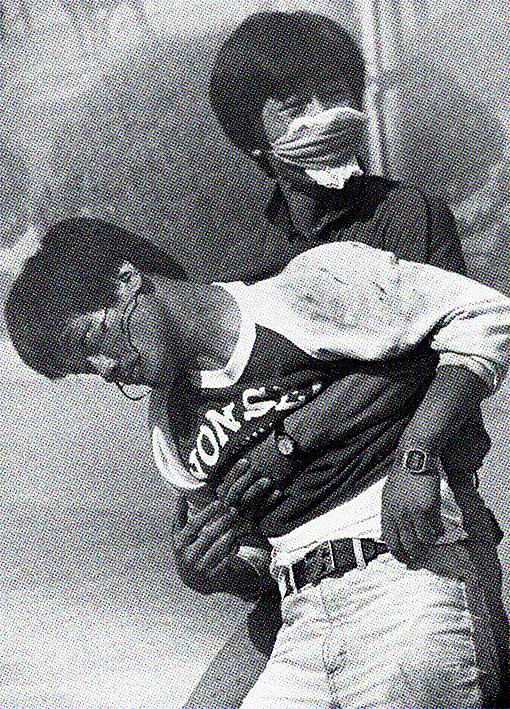

6월9일 오늘의 역사 – 나치의 보복, 이한열 열사 사망, 유고슬라비아와 NATO 평화협정, 독도의 달 조례. 홍콩 민주화 운동

6월9일 오늘의 역사 – 나치의 보복, 이한열 열사 사망, 유고슬라비아와 NATO 평화협정, 독도의 달 조례. 홍콩 민주화 운동

AI 수출컨설던트

AI 수출컨설던트

45년생 꼼꼼한 국어선생님이 평생 다듬고 가려 뽑은 순우리말사전

45년생 꼼꼼한 국어선생님이 평생 다듬고 가려 뽑은 순우리말사전

목록

목록